Seit Jahren behalten wir bei Treasurer Search alle Vakanzen im Bereich Corporate Treasury sowie TMS im Blick. In der Regel werten wir diese Daten ausschließlich intern aus. Da ich jedoch regelmäßig nach Marktinsights gefragt werde, haben wir uns in diesem Jahr dazu entschieden, die Daten zu veröffentlichen.

2025 zeigt das höchste Aktivitätsniveau, das jemals in unserer Datenbank erfasst wurde, mit 517 Treasury‑Vakanzen in Deutschland.

!Wichtiger Hinweis: Treasury-Vakanzen bei Banken sind nicht enthalten. Ebenso wenig berücksichtigt sind Positionen bei den Big Four, da diese nahezu durchgehend auf der Suche nach Kandidatinnen und Kandidaten sind. Hiermit veröffentlichen wir unseren ersten offiziellen Report.

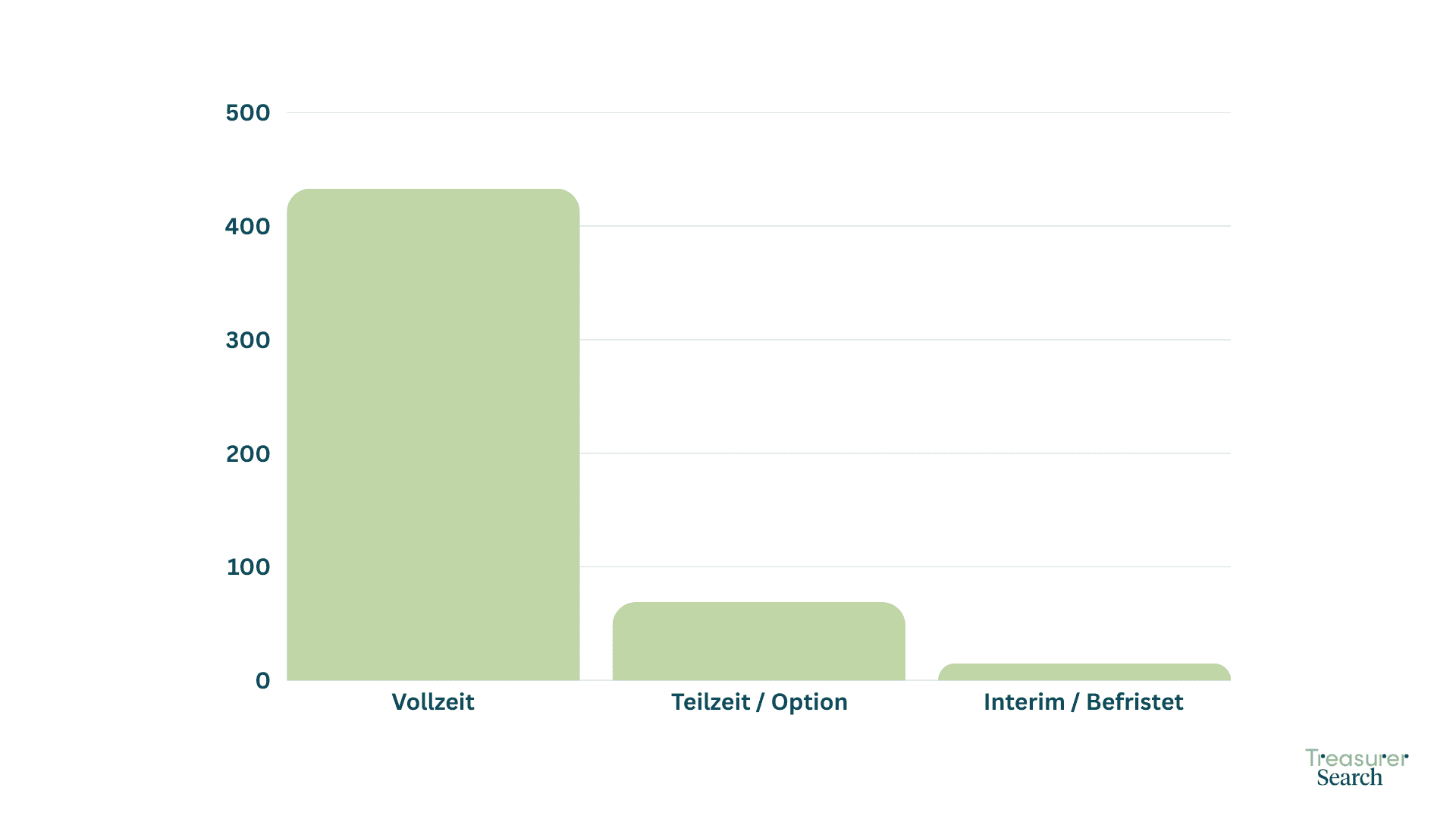

Vertragsarten

Die Auswertung der Vertragsarten zeigt deutlich, dass unbefristete Festanstellungen den Markt dominieren. Befristete Positionen oder Interim-Lösungen spielen nur eine untergeordnete Rolle. Das ist typisch für den Treasury-Bereich, in dem Stabilität und der langfristige Aufbau von Know-how eine zentrale Rolle spielen.

Senioritäten

Bei den Senioritäten fällt auf, dass Mid-Level- und Senior-Profile im Jahr 2025 klar im Fokus standen. Junior-Positionen wurden deutlich seltener ausgeschrieben. Dies läßt darauf schließen, dass Treasury-Teams verstärkt nach erfahrenen Spezialistinnen und Spezialisten suchen.

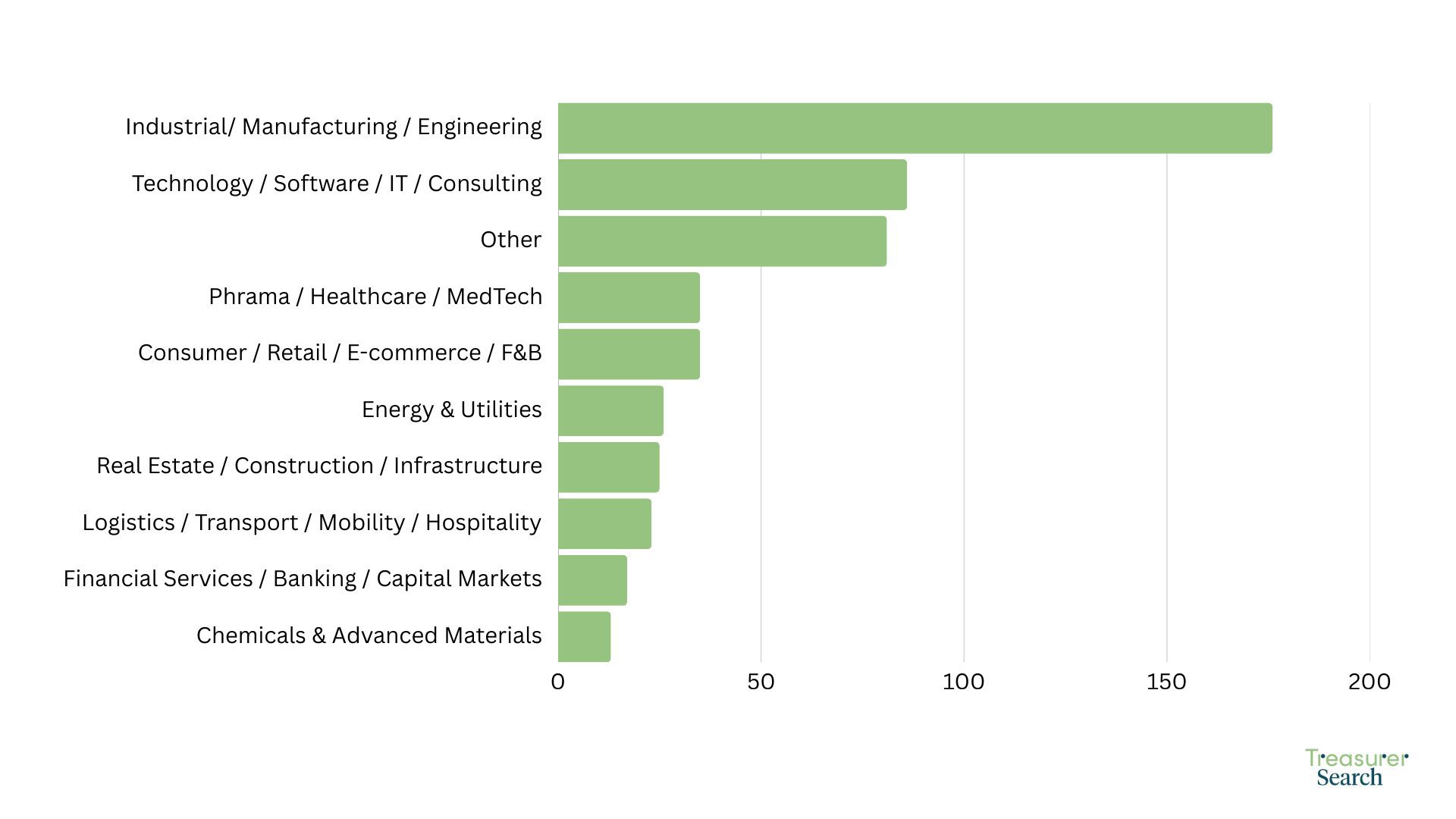

Industrien

In den Industrien zeigt sich die gewohnte Breite: Von klassischer Industrie über Handel bis zu spezialisierten Technologieunternehmen ist alles dabei. Treasury bleibt ein Querschnittsbereich, der in nahezu jeder Branche benötigt wird.

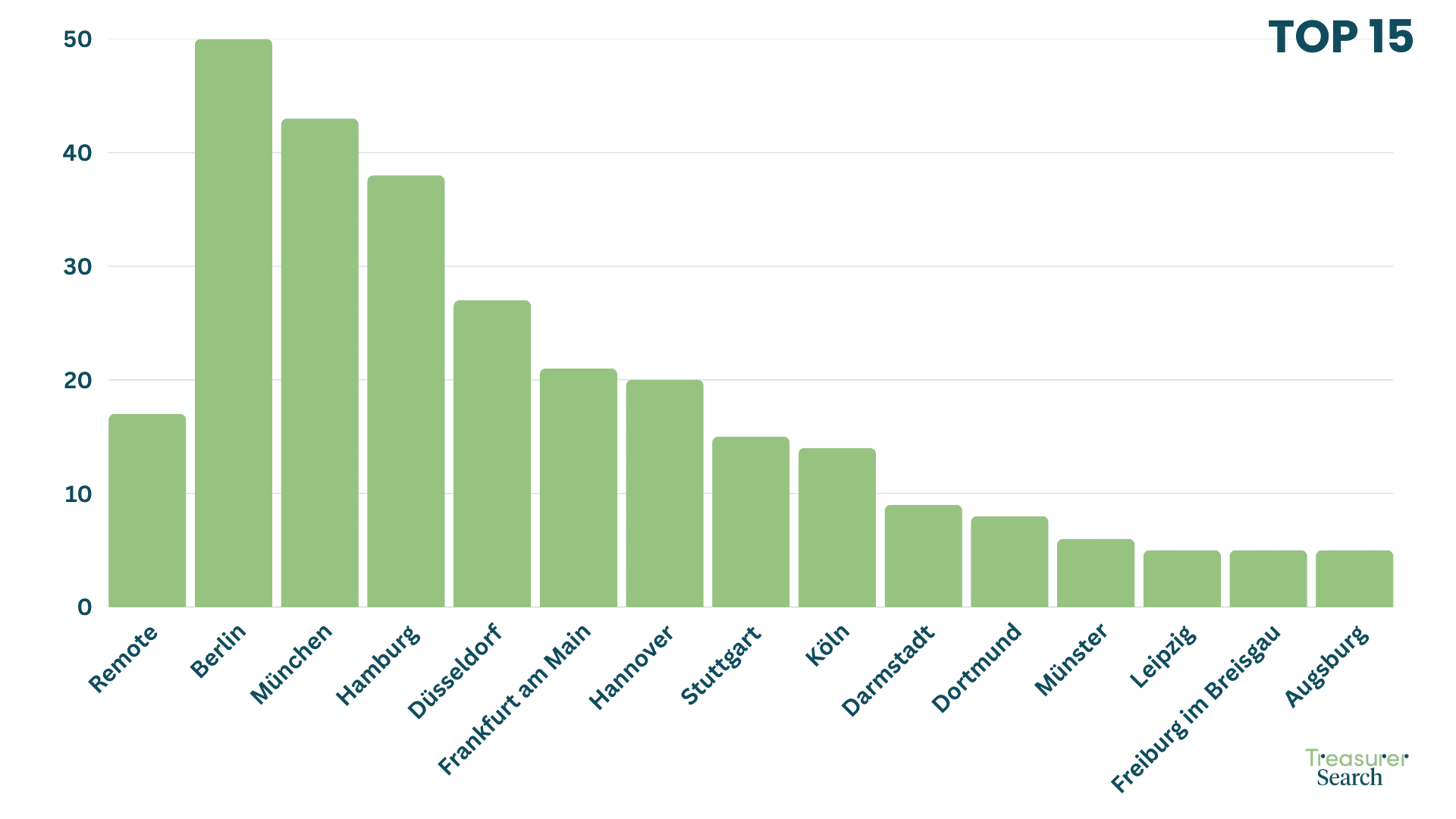

Standorte

Die Städte-Verteilung bestätigt erneut den bekannten Trend: Treasury-Vakanzen konzentrieren sich auf die großen wirtschaftlichen Zentren Deutschlands, während der Süden weiterhin die höchste Dichte aufweist.

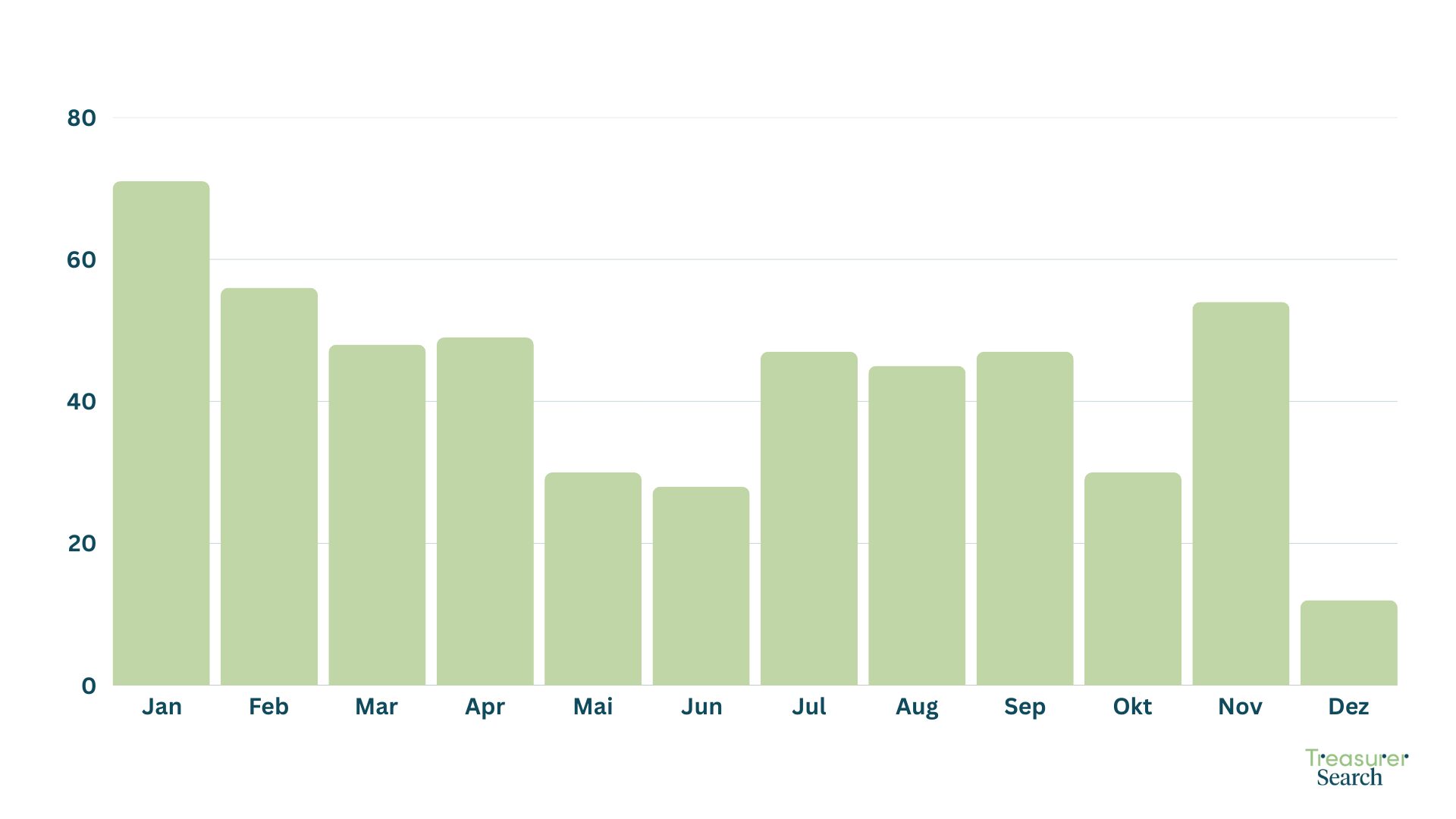

Veröffentlichungsdatum

Hier zeigt sich eine relativ gleichmäßige Verteilung über das Jahr, mit typischen Ausschlägen zu Jahresbeginn und nach der Sommerpause.

Das ist der erste Teil unserer Analyse. Da wir auch alle Stellenbeschreibungen systematisch erfassen, folgt bald ein zweiter Teil des Reports.

Darin gehen wir tiefer auf die Inhalte ein: welche Anforderungen gestellt wurden, welche Skills und Technologien gefragt waren, welche Modelle (Hybrid, Office, Remote) angeboten wurden und welche Sprachkenntnisse Arbeitgeber wollten. Mehr dazu in Teil 2.

Wenn Sie Fragen haben, die Ergebnisse weiter diskutieren möchten oder Anregungen für spezifische Themen haben, wenden Sie sich gerne an Antonio. Wir freuen uns jederzeit über den Austausch von Ideen.