Why the Netherlands Leads, Germany Differs, and Belgium Lags Behind

When discussing the treasury interim market in Europe, three neighbouring countries offer a fascinating contrast: the Netherlands, Germany, and Belgium. Despite their geographic proximity, the maturity, dynamics, and mindset surrounding interim treasury professionals differ significantly.

Understanding these differences is crucial, not only for hiring managers but also for treasury professionals navigating cross-border opportunities.

The Netherlands: A True Interim Market

The Netherlands has firmly established itself as a mature interim market. Interim hiring is not viewed as an exception or a last resort, but as a fully accepted workforce strategy.

Dutch organisations typically prefer to work with one trusted supplier rather than engaging multiple agencies simultaneously. This model is built on partnership and confidence: clients rely on their chosen provider to deliver a curated selection of high-quality profiles.

Rather than creating noise, this approach creates efficiency.

Clients still retain choice, but without duplicated efforts, conflicting communication, or unnecessary market friction.

Another structural factor contributes to the Netherlands’ strong interim culture: lean treasury teams.

Compared to many other European countries, Dutch treasury departments are often relatively small. When a team member becomes unavailable, whether due to resignation, illness, parental leave, or project demands, the operational pressure on remaining colleagues increases rapidly.

In such environments, interim professionals are not a luxury.

They are a pragmatic solution.

Germany: Structured, Selective, and Project-Driven

Germany presents a different landscape.

Treasury teams are typically larger and more layered. As a result, immediate operational urgency tends to be less acute. Instead of reacting quickly to temporary gaps, German organisations more frequently engage interim professionals for specific projects or specialised initiatives.

These assignments, however, arise less frequently.

Another notable characteristic of the German market is its hiring approach. It is common for organisations to invite multiple agencies to search for candidates simultaneously, effectively sending everyone to “fish in the same pond.”

While this may appear competitive, it creates unintended consequences.

Only one agency will ultimately be compensated for its efforts. The others absorb the cost of unbillable time, research, and candidate engagement. Over time, this dynamic inevitably influences pricing structures. Margins rise. Ironically, the client later questions these higher margins, a familiar debate within many professional communities.

There is also a candidate-side impact. Interim professionals are often approached multiple times for the same assignment, generating confusion and fatigue rather than a positive hiring experience.

Efficiency, once again, becomes the hidden casualty.

Belgium: A Market Still Finding Its Way

Belgium represents yet another stage of market evolution.

The concept of treasury interim professionals is still less deeply embedded. When Belgian organisations consider temporary external expertise, they often turn first to the Big Four consulting firms rather than independent contractors or specialized interim professionals.

This preference has clear implications.

Consulting-driven solutions frequently come with significantly higher cost structures, while the flexibility and agility of independent interim professionals remain underutilized.

This difference is visible in market activity: the pool of active treasury interim professionals in Belgium remains comparatively limited.

Simply put, the ecosystem is still developing.

Language: The Silent Market Shaper

Beyond structural and cultural factors, language requirements play a decisive role across all three markets.

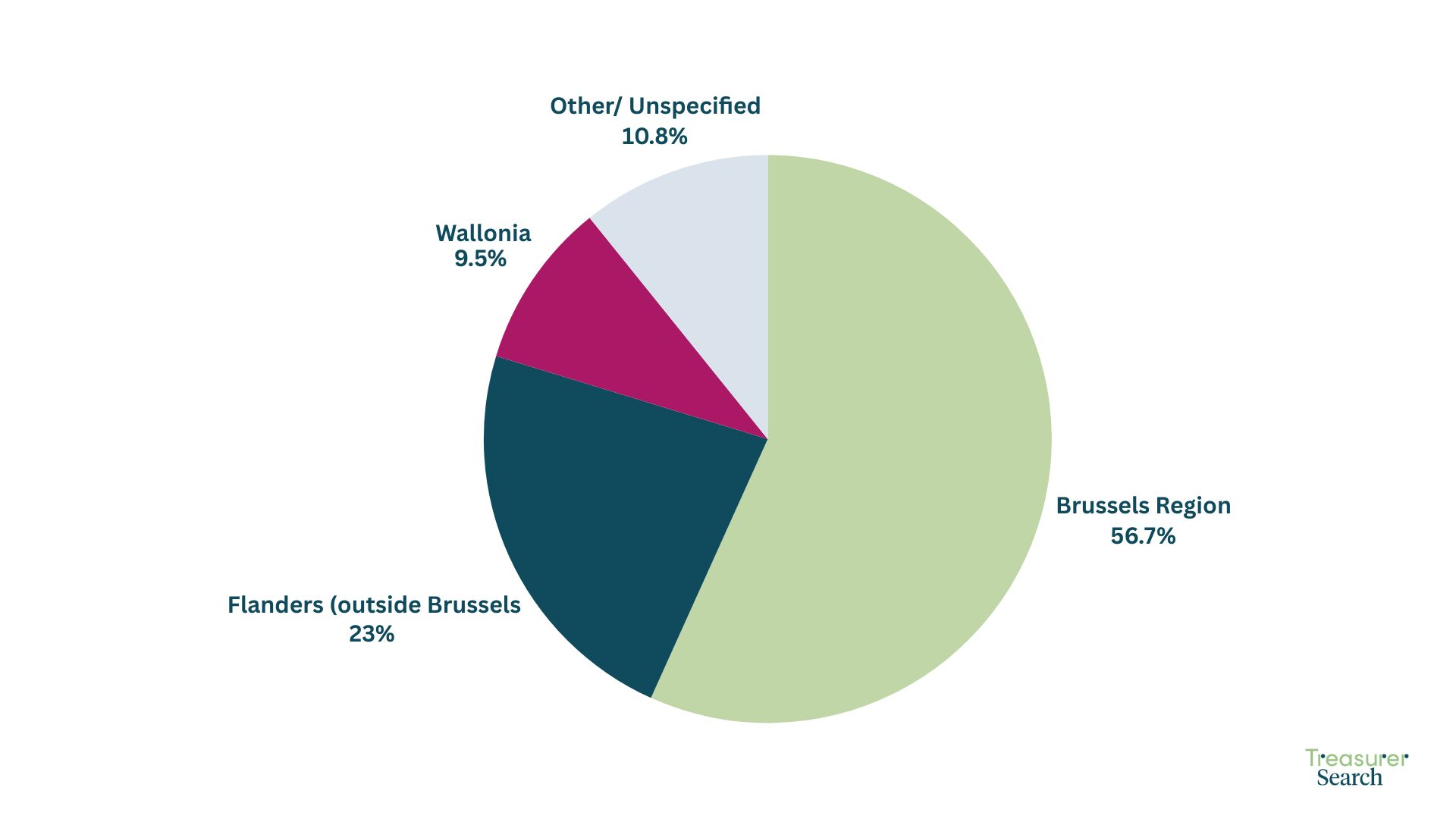

Belgium strongly favours Belgian nationals or French-speaking professionals.

Germany typically requires fluency in German alongside English.

The Netherlands stands out for its flexibility: in many cases, English proficiency alone is sufficient.

This openness significantly broadens the available talent pool and reinforces the Netherlands’ position as the most dynamic treasury interim market in the region.

Market Ranking: A Clear Order

When combining market maturity, hiring dynamics, and accessibility, a natural ranking emerges:

The Netherlands: the most mature and fluid interim treasury market

Germany: structured, selective, and project-oriented

Belgium: still evolving and consultant-driven

What This Means for Treasury Professionals and Hiring Managers

For organisations, recognising these differences enables smarter workforce strategies. Interim hiring is not merely about filling gaps, it is about choosing the right model for operational continuity, expertise deployment, and cost efficiency.

For treasury professionals, market awareness shapes career decisions. Language capabilities, mobility, and expectations must align with local market realities.

One lesson stands out across all borders:

The interim market is not just about availability.

It is about mindset.

And in that respect, the Netherlands continues to set the pace.