The Belgian treasury market in 2025 reflects a function that has largely moved beyond basic cash management and into a more strategic, experience-driven role within organisations. Across sectors, companies are looking for treasury professionals who can operate independently, manage complexity, and contribute to financing, risk management, and transformation initiatives.

By looking at seniority levels, industry distribution, and geographic concentration, a clear picture is painted of how treasury roles are positioned in Belgium today, and where demand is structurally strong or limited. The data below highlights not only who is being hired, but also what kind of treasury function organisations are building.

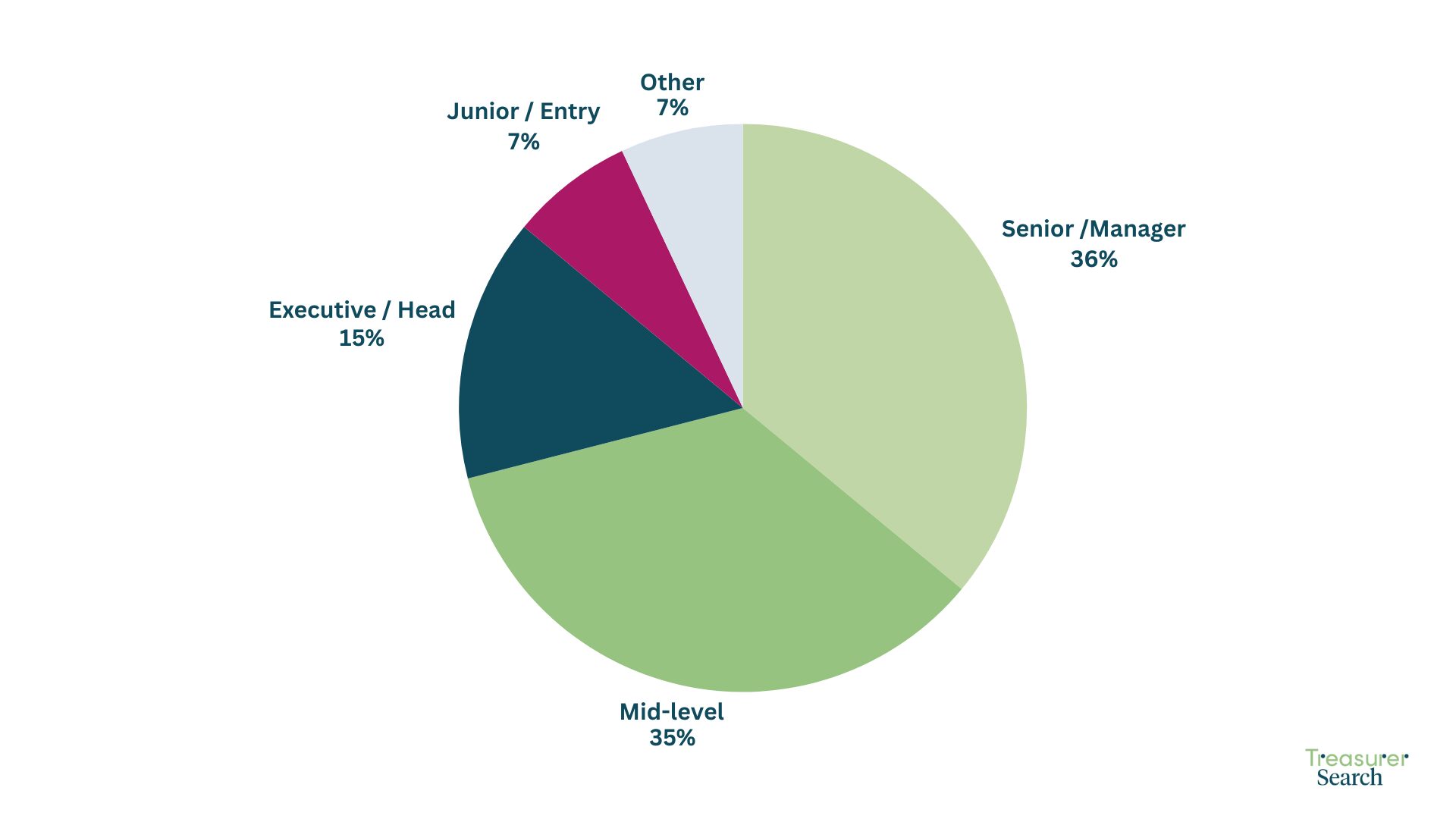

Seniority Level:

The Belgian treasury market in 2025 was clearly tilted toward experienced profiles. Senior and managerial roles made up 36% of the market, closely followed by mid-level positions at 35%. Together, this means over 70% of treasury hiring targeted professionals with solid hands-on experience rather than entry-level talent.

Executive and Head of Treasury roles accounted for 15%, which is relatively high and points to ongoing leadership turnover, transformation projects, and succession planning. Junior and entry roles remained limited at just 7%, confirming that Belgium continues to be a tough market for early-career treasury profiles.

Industry Overview:

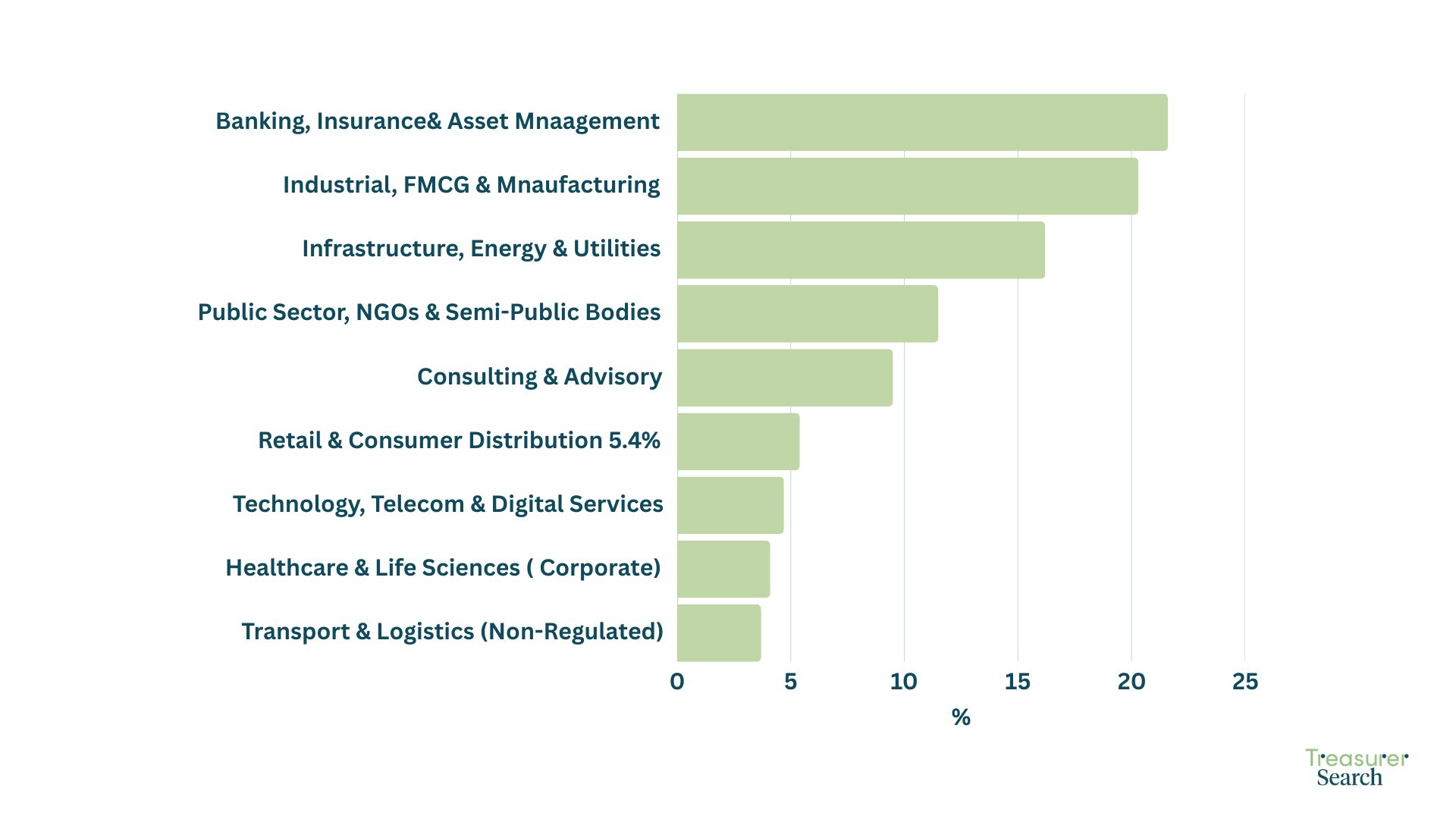

From an industry perspective, demand was well diversified but still higher in traditional sectors. Banking, insurance, and asset management led with 21.6%, narrowly ahead of industrial, FMCG, and manufacturing at 20.3%.

Infrastructure, energy, and utilities followed strongly at 16.2%, reflecting continued investment, financing complexity, and cash management needs in capital-intensive sectors.

The public and semi-public space also played a meaningful role at 11.5%, while consulting and advisory firms represented nearly 10%, underlining sustained demand for treasury transformation and project expertise.

Location Overview:

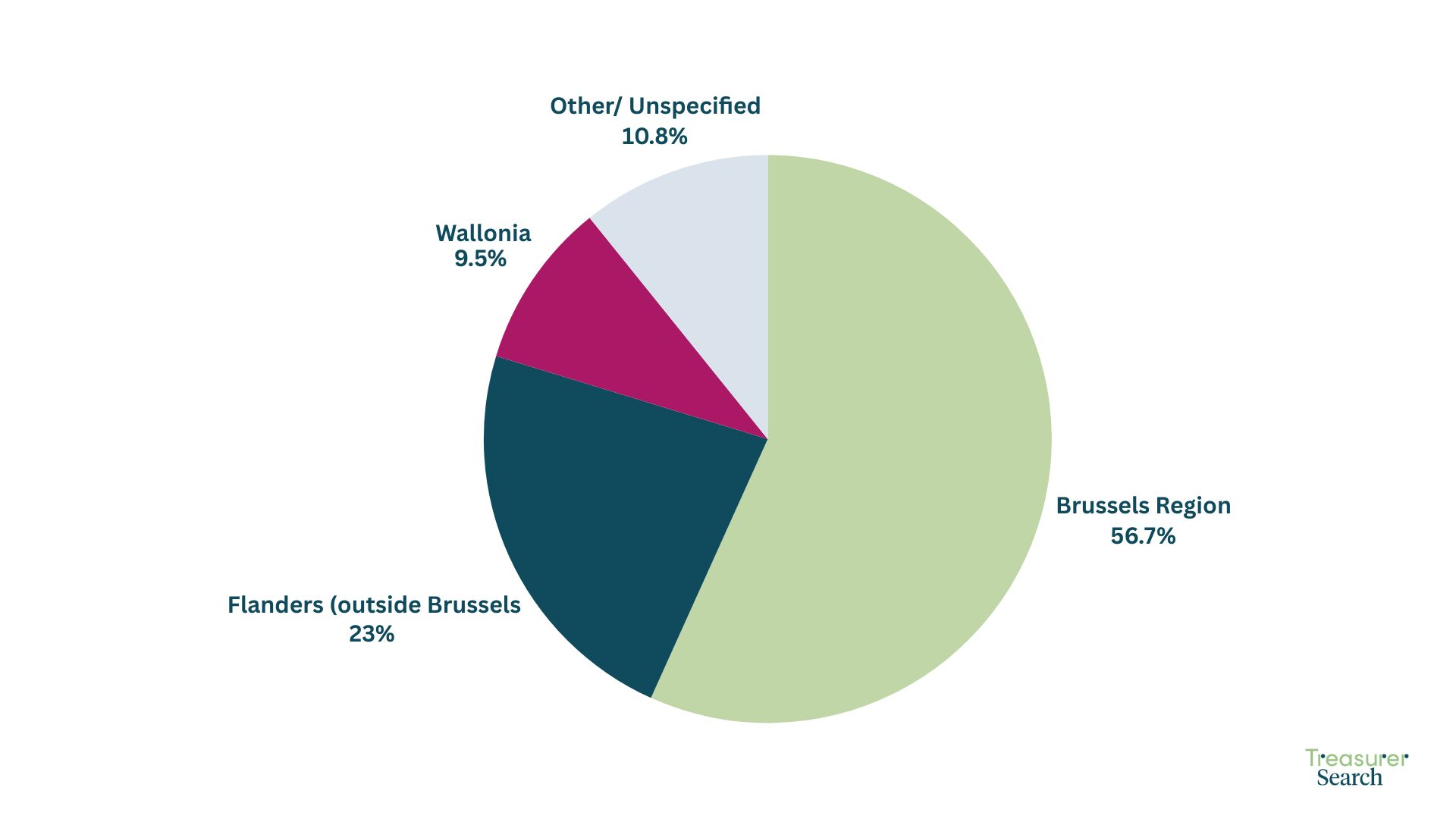

Geographically, the market remained highly centralized. Nearly 57% of roles were based in the Brussels region, including key business hubs such as Zaventem and Diegem. Flanders accounted for 23%, driven mainly by Antwerp and surrounding industrial clusters, while Wallonia represented a smaller share at 9.5%.

The remaining 10.8% reflects roles with a national scope or less specific location data, often linked to hybrid or multi-site setups.

Taken together, the 2025 data paints a picture of a mature and selective treasury market. Demand is concentrated at experienced levels, leadership roles are actively evolving, and junior entry points remain structurally limited. Industry demand is diversified but still rooted in financial services, industry, and infrastructure, while geography continues to favour Brussels as the dominant treasury hub.

For employers, this means competition for experienced treasury talent remains high. For professionals, it reinforces the importance of depth, adaptability, and cross-sector exposure. Belgium in 2025 is not a high-volume hiring market for treasury, but it is a market where expertise, leadership, and strategic capability are clearly valued.

If you want to discuss more on this topic, reach out to our Belgium specialist, Haia Aaraj.